5 Reasons You Should Consider Earning a Degree in Actuarial Mathematics

Are you good at math? Do you enjoy solving complex problems? Does using statistics to predict future trends sound like an appealing job description? If so, earning a degree in actuarial mathematics in order to become an actuary could be right up your alley.

Actuaries work for banks, insurance companies, state and federal organizations, brokerages, consulting firms, political entities, and NGOs. Job duties include compiling statistical data for analysis, estimating the probability and cost of various events, and testing policies and business plans to maximize profits while reducing risk. Actuaries are also tasked with explaining their findings and suggestions to clients, supervisors, or shareholders. Most work in an office but those who work as consultants have many travel opportunities. Telecommuting is also an option.

If you're not familiar with this degree option or are unsure of what it could do for your future, consider the following five reasons why you should seriously consider earning an actuarial mathematics degree.

- High Earning Potential

The Bureau of Labor Statistics notes that the annual median wage for actuaries is $111,030, or well over $50 an hour. The median annual salary rises dramatically depending on one's employer and geographic location. The states of New York, New Hampshire, Connecticut, North Carolina, and Washington D.C. are the most lucrative for actuaries, as mean annual salaries range from $136,000 to $154,000. Actuaries who work for business, labor, political, and professional organizations earn a mean annual salary of $173,070 while those working for credit intermediation and in related activities earn a mean annual salary of $154,250. Additionally, many actuaries also receive benefits such as health care, dental care, paid vacation, paid leave, etc.

- Job Security

Actuaries are in high demand. The Bureau of Labor Statistics reports that job growth in this field is a whopping 24%, much faster than the average for all professions. Job security is a sure thing as companies will not be able to easily replace you.

- You'll Never Get Bored

Working with data and statistics can be fascinating. You'll be tasked with discovering current trends and predicting future ones. You'll be able to analyze how people think, what makes them react, and what the most likely outcome is for a range of scenarios.

Actuaries typically work in offices either on their own or as part of a team that includes accountants, business executives, and/or managers. However, you can also work directly with clients in a consulting capacity, a job that would enable you to travel around the state, country, or even the world. If a particular job no longer suits your fancy, you can easily pack up and find work in another location or industry.

- You'll Be a Valued Member of Your Team

The internet has made it possible to access data like never before, including personal information that can be used for marketing, product design and creation, and other purposes. What's more, modern technology has empowered the business world to sort through data and categorize it according to various criteria. However, companies still need people who can fully understand data, what it means, and how to act on it. That's where you, as an actuary, come into the picture.

It takes a strong knowledge of math to understand the difference between coincidental occurrences and ongoing trends. You’ll also have the skills to differentiate between passing trends and long-lasting ones. You'll be able to continually monitor data to see when a current trend is ending and a new one is taking its place. These skills will make you an invaluable member of any team. Managers, business executives, shareholders, and clients will value what you have to offer because they understand the importance of your work. Your suggestions will be taken seriously, and your research will gain the attention of those who are willing to pay top dollar for your services. In short, you will be a valued team member no matter where you work.

- Multiple Career Options

Another benefit of earning an actuarial mathematics degree is that becoming an actuary isn't your only job option. If you find that actuarial work isn't your cup of tea, you can use your degree to find work as an accountant, economist, budget or financial analyst, mathematician, statistician, or personal financial advisor. You can also use your degree to become a post-secondary teacher at a high school, college, or university.

Alternatively, you can opt to specialize in a particular actuarial field. Enterprise risk actuaries analyze economic, financial, and even geopolitical risks to help a company or government develop plans to mitigate potential risks. Pension and retirement benefits actuaries analyze pension plans to ensure they are sound and profitable long-term. Health insurance and life insurance actuaries work for insurance firms to analyze insurance policies, identifying risks that could lead to a shorter lifespan and an increased risk of sickness.

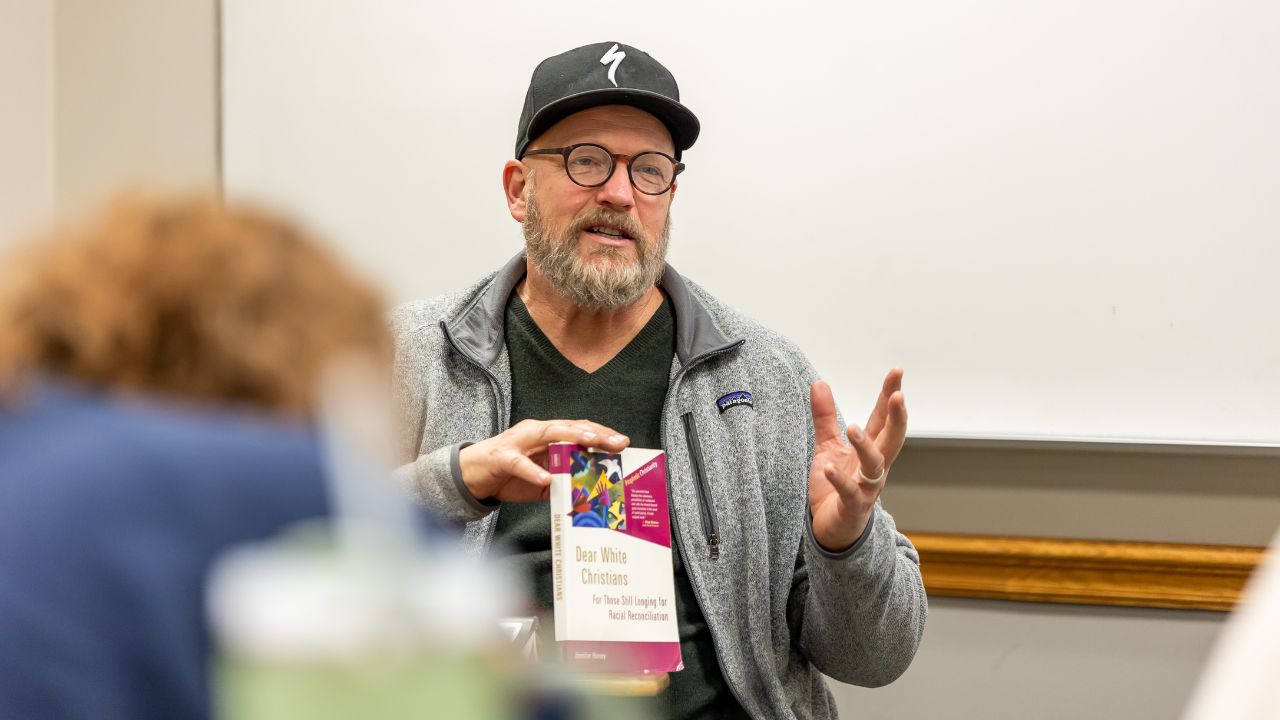

A degree in actuarial mathematics is a must if you want to work as an actuary or in a related field. As part of your studies, you’ll learn analytics, project management, accounting, economics, and other invaluable skills. At the same time, a truly good degree program won't settle for only teaching you these skills. In order to succeed as an actuary, you'll need important soft skills and qualities such as a strong ethical foundation, written and oral communication skills, self-discipline, independence, self-motivation, and teamworking skills. These personal skills, coupled with professional training, will help you become a successful actuary no matter where you live or which industry you work in.

Geneva College is an accredited Christian College of Distinction and has been rated one of the best colleges and universities in the United States by the U.S. News and World Report. We offer an actuarial mathematics degree program that is second to none; what's more, we offer training in the skills you'll need to not only earn a living but also make the best possible life for yourself and your family. For more information on how Geneva College can help you pursue your career goals, contact us at 855-979-5563 or web@geneva.edu.

Opinions expressed in the Geneva Blog are those of its contributors and do not necessarily represent the opinions or official position of the College. The Geneva Blog is a place for faculty and contributing writers to express points of view, academic insights, and contribute to national conversations to spark thought, conversation, and the pursuit of truth, in line with our philosophy as a Christian, liberal arts institution.

Nov 17, 2021Program SpotlightRelated Blog Posts

Request Information

Learn more about Geneva College.

Have questions? Call us at 724-847-6505.

Online Course Login

Online Course Login